Property Tax Calculator

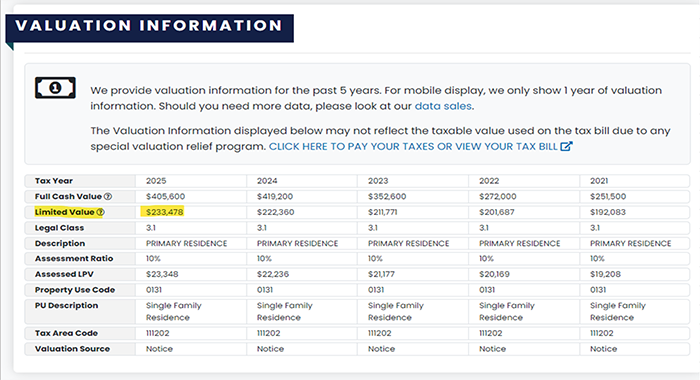

The Calculator below will calculate your estimated Queen Creek Unified School District Override Continuation related property taxes. To use the calculator, you will need the "Limited Property Value" of your property. This is not the current fair market value of your home, but rather the Limited Property Value as calculated by the Maricopa County Assessor. Property taxes are levied on the Limited Property Value which is statutorily limited to a 5% increase over the previous year’s LPV (A.R.S. §§ 42-13301 through 13304).This amount can be located on the Property Notice of Valuation that is mailed each year from the Maricopa County Assessor online by visiting the Maricopa County Assessor website.

Once on the website, you can search for your property either by parcel number or street address and then review the valuation information.

Interactive Calculator

Enter your limited property value in the first box below.